Federal Gift Tax Limit 2025. From april 1, 2025, maturity proceeds from life insurance policies issued where the total premium exceeds rs 5 lakh will be subject to taxation. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.

Understanding the 2025 gift tax limit and changes for 2025 in 2025, the irs set the lifetime gift tax exemption at $12.92 million, enabling individuals to transfer this. The 2025 gift tax limit was $17,000.

Tax extensions extended for startups and businesses in gujarat’s gift city, as well as sovereign funds and foreign pension funds will attract new investments in the.

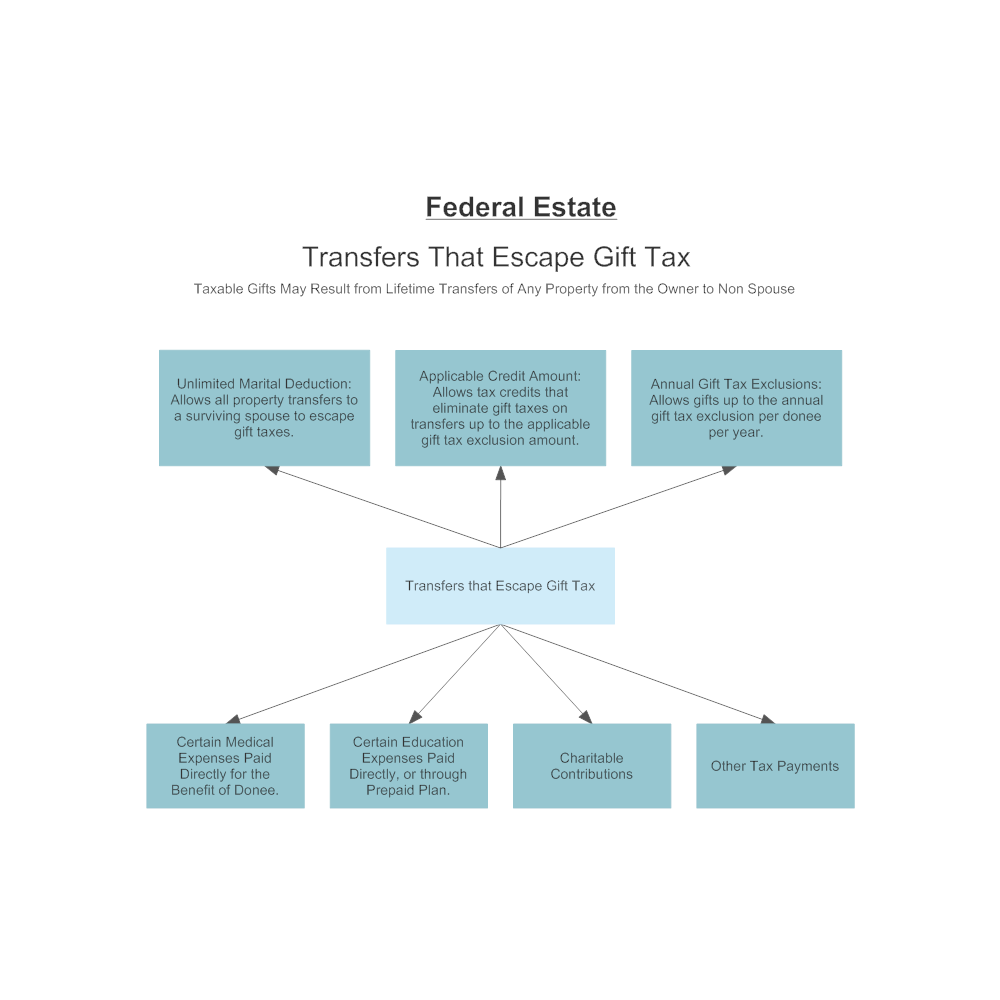

Federal Gift Tax Escapes, The gift tax limit (or annual gift tax exclusion) for 2025 is $17,000 per recipient. 1 for 2025, the limit has been adjusted for inflation and will rise to $18,000.

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, Remaining lifetime exemption limit after gift: (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.

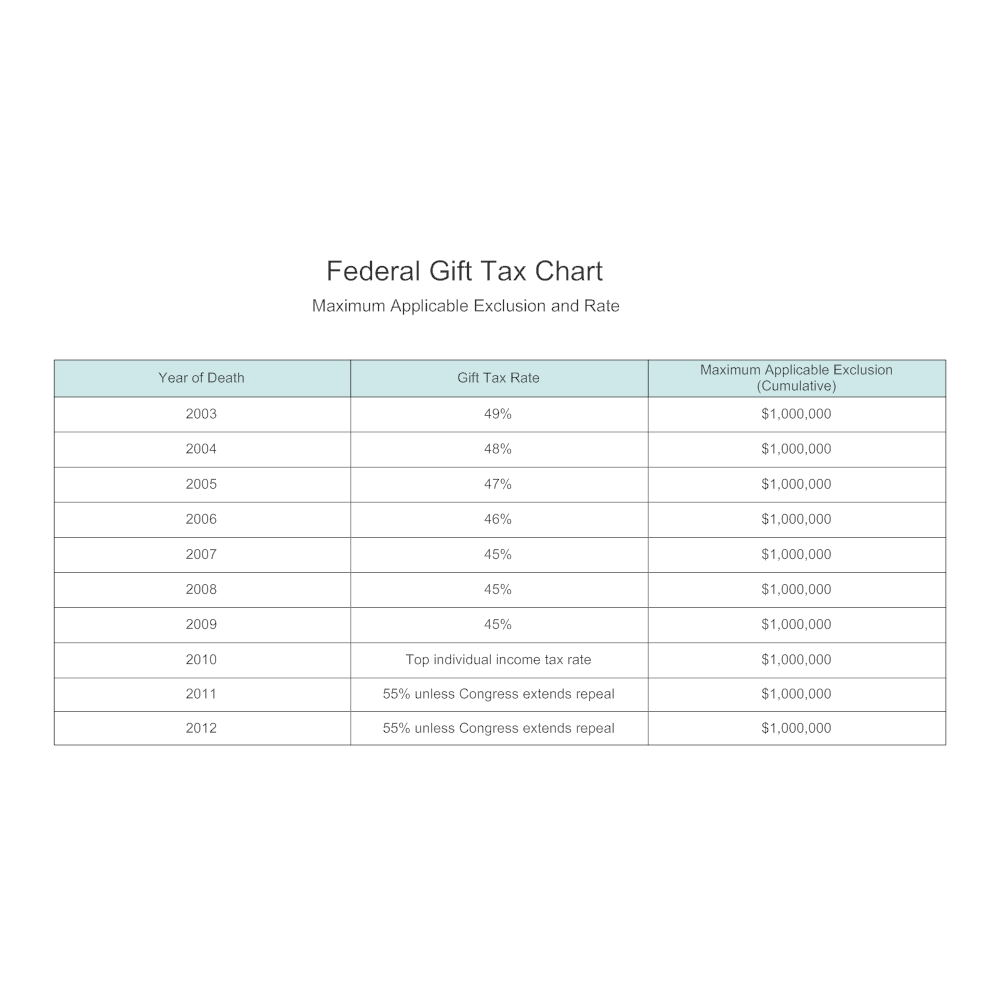

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, [1] ct gift and estate tax is unified, so that lifetime gifts deplete. The 2025 gift tax limit was $17,000.

Lifetime Gifting Limit 2025 Hildy Joletta, For 2025, the gift tax exclusion is $18,000 per gift recipient. 2025 gift tax exemption limit:

Federal Gift Tax 2025 Elene Hedvige, 2025 gift tax exemption limit: The gift tax limit (or annual gift tax exclusion) for 2025 is $17,000 per recipient.

Gift Tax Rate Table 2025 Beckie Joelynn, The faqs on this page provide details on how tax reform affects estate and gift tax. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Things you should know about the Federal gift tax in USA Advisory, 1 for 2025, the limit has been adjusted for inflation and will rise to $18,000. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Auto lease rate calculator zones, personal loan calculator ulster bank, The internal revenue service recently announced that the federal estate and gift tax exemption amounts will be $13.61 million per individual for gifts and deaths. For 2025, the gift tax exclusion is $18,000 per gift recipient.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, These gifts can include cash as well as other. [1] ct gift and estate tax is unified, so that lifetime gifts deplete.

Estate Tax Exemption Increased for 2025 Anchin, Block & Anchin LLP, Below is a summary of the states that as of 2025 still impose estate, gift, or inheritance tax: Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient.

Economists in the biden administration are calling for more aggressive federal action to drive down costs for home buyers and renters, taking aim at one of the.